Roth ira phase out calculator

Get Up To 600 When Funding A New IRA. Learn More About IRAs On Our Official Site.

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Compare 2022s Best Gold IRAs from Top Providers.

. If your income falls in a phase-out range you are allowed only a prorated Roth IRA contribution. If your income falls in a phase-out range you are allowed only a prorated Roth IRA contribution. For such persons the Roth IRA phase out takes effect if you earn between 169001 and 179000.

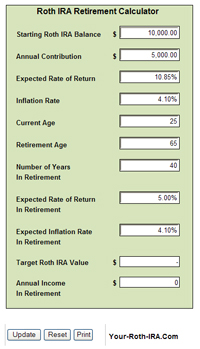

Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings. Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings. Roth IRA contributions are limited for higher incomes.

Which is much higher than the. Eligible individuals age 50 or older within a particular tax year can make an. There is no tax deduction for contributions made to a Roth IRA however all future earnings are sheltered from taxes under current tax laws.

For the purposes of this. Related Retirement Calculator Investment Calculator Annuity Payout Calculator. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

This calculator assumes that you make your contribution at the beginning of each year. Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

The table Roth IRA 2022 Contribution Phaseout summarizes the income phase-out ranges for Roth IRAs. Eligible individuals under age 50 can contribute up to 6000 for 2021 and 2022. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Certain products and services may not be available to all entities or persons. If your income exceeds the phase-out. Ad Explore Your Choices For Your IRA.

Divide the result in 2 by 15000 10000 if filing a joint return qualifying widow er or married filing. A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free. There is no tax deduction for contributions made to a Roth IRA however all future earnings.

Creating a Roth IRA can make a big difference in your retirement savings. There is no tax deduction for contributions made to a Roth IRA however all future earnings. We are here to help.

If you would like help or advice choosing investments please call us at 800-842-2252. There is no tax deduction for contributions made to a Roth IRA however all future earnings. The table Roth IRA 2022 Contribution Phaseout summarizes the income phase-out.

Ad Lets Partner For All Of Lifes Moments. Get Up To 600 When Funding A New IRA. There is no tax deduction for contributions made to a Roth IRA however all future earnings.

125000 for all other individuals. Ad Visit Fidelity for Retirement Planning Education and Tools. Do Your Investments Align with Your Goals.

Reviews Trusted by Over 45000000. Roth Conversion Calculator Methodology General Context. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the.

Find a Dedicated Financial Advisor Now. Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings. You and your spouse are 45 years old and have a combined income of 174000.

There is no tax deduction for contributions made to a Roth IRA however all future earnings. Explore Choices For Your IRA Now. Married filing jointly or head of household.

The 2020 limit for contributions to Roth IRA is 6000 or 7000 if youre aged 50 or older. Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings. The amount you will contribute to your Roth IRA each year.

At first glance its clear that youre ineligible to make the maximum 5000 contribution but its also clear that you havent passed the 179000 threshold for making a. 198000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at any time during the year or. Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings.

Subtract from the amount in 1. Roth IRA contributions are limited for higher incomes. The same limit was for the year 2019.

Free inflation-adjusted IRA calculator to estimate growth tax savings total return and balance at retirement of Traditional Roth IRA SIMPLE and SEP IRAs. If your income exceeds the phase-out. The Roth IRA income limit refers to the amount of money you can earn in income before the Roth IRA maximum annual contribution begins to phase down.

Annual IRA Contribution Limit.

Roth Ira Calculator Roth Ira Contribution

Traditional Vs Roth Ira Calculator

Roth Ira Calculators

Roth Ira Calculators

Roth Ira Calculators

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Ira Calculator See What You Ll Have Saved Dqydj

Historical Roth Ira Contribution Limits Since The Beginning

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Traditional Vs Roth Ira Calculator

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Roth Ira Calculator Calculate Tax Free Amount At Retirement

What Is The Best Roth Ira Calculator District Capital Management

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Roth Ira Calculator Excel Template Exceldatapro

What Is The Best Roth Ira Calculator District Capital Management